Moving To Scotland From US

Get a Free Moving Quote Now!

Start Your International Moving Journey

Scotland is a country located in the northern part of the United Kingdom and the second largest country. The country is known for its stunning landscapes, including picturesque highlands, ancient castles, and beautiful lochs.

Scotland is famous for its rich history, vibrant culture, and friendly people. The country offers various outdoor activities, such as hiking, golfing, and fishing, as well as a thriving arts and music scene.

Travelers to Scotland can explore its historic cities, including Edinburgh and Glasgow, and sample traditional Scottish cuisine, such as haggis and whisky. Overall, Scotland has a lot to offer for both travelers and people who want to move to Scotland from the USA for long term stay.

The International Sea & Air Shipping Advantages

An international relocation is not easy and can be a lot to handle! There is a lot to process when you have taken the decision to move to Scotland from the USA. You need to get the paper-works done, packing of your household goods to be done and then there is the actual process of moving overseas and then settling down in a new geography altogether!

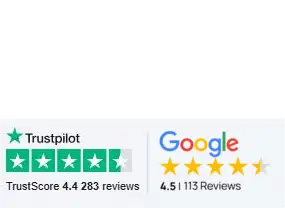

At International Sea & Air Shipping our team understands each and every step of an international relocation. Whether it is to get you ready for the documentation processes or giving you proper guidance on the move – we have our expert team to assist you at every step. We specialize in many aspects of the relocation like moving the household goods or moving your car to your preferred country of relocation.

International moving can be quite heavy on the pocket, too. But with us at International Sea & Air Shipping you will get cost effective services that are tailored to your moving needs! We have in-house international moving experts who will use their knowledge and expertise to offer you the best end-to-end relocation to Scotland from the USA. So, let our professionals handle your international relocation and move to the Land of the Brave with a brave heart!

About Scotland

Part of the United Kingdom, the country of Scotland makes up the northern third of the island of Great Britain. In addition to the mainland, Scotland is comprised of more than 790 islands and is regarded as the highest educated country in Europe.

A federal semi-presidential republic, the President is considered the head of the state and the Prime Minster the head of the government.

Although Scotland’s capitol is Edinburgh, the largest city in the country is Glasgow – Edinburgh lands in second – with the urban center of Greater Glasgow making up a quarter (almost 1.2 million) of Scotland’s population. All major Scottish cities are located in the Central belt with the exception of Aberdeen (the third largest city and Europe’s oil capital).

Scotland is perhaps most well-known for the body of water known as Loch Ness, a 23 mile freshwater lake famous for alleged sightings of the creature dubbed the Loch Ness Monster.

English, Scots and Scottish Gaelic are the three official languages of Scotland, with almost all of the population speaking Scottish English.

Customs Regulations for Scotland

DOCUMENTS REQUIRED FOR ENTRY

- Valid passport

- Visa

- Work permit

- Detailed inventory of household goods and personal effects (in English, two copies – valued, dated and signed by the Customer)

- Customs Form/Import Declaration (two completed originals)

- C-3 (household goods and personal effects for primary residence)

- C-33 (household goods and personal effects for secondary residence)

- C426 (for diplomatic entry only)

- C104A/C104F/C384 (motor vehicles)

- C-5 (pets)

- Keys for any locked items

CUSTOMS REGULATIONS

- Your household goods and personal effects must arrive within one year of your arrival, or up to six months before your arrival in Scotland.

PROHIBITED ITEMS

In Scotland, some articles may not be imported in a customer’s baggage whatsoever. These items include, but may not be limited to:

- Handguns other than .22 caliber target pistols (all others are illegal in the United Kingdom)

- Ammunition, switchblades and other weapons

- Explosives and fireworks

- Drugs and narcotics

- Counterfeit currency

- Pornographic material

- Horror comics

- Meat, poultry, fish and other animal products

- Radio transmitters (CB radios, walkie-talkies, cordless phones, etc.) not approved for use in the United Kingdom

- Trees, some plants, shrubs, seeds, bulbs, soil, potatoes and other vegetables and fruit

- Most animals and all birds dead or alive and certain articles derived from endangered species (i.e. ivory, reptile leather, etc.)

DUTIABLE/RESTRICTED ITEMS

Some articles may have restricted quantities or require special authorization/ payments of duties and taxes to clear customs in Scotland. These items include, but are not limited to:

- Firearms (require valid certificate issued by police)

- New items, less than six months old (require invoice)

- Alcohol, tobacco and perfume products (dutiable and must be declared on the Customs Form)

- Plants (require Phytosanitary Certificate)

MOTOR VEHICLE REGULATIONS

In Scotland, the following rules apply to importing motor vehicles:

- You are moving your primary residence to the United Kingdom (if you lived outside of the European Commission (EC), you must have been abroad for more than one year and your vehicle must have been owned and used abroad for at least six months)

- Your vehicle was not purchased under a duty/tax free scheme, it is for personal use and will not be resold within one year of importation

You will need the following documents:

- Declaration to HM customs, which must specify:

- Year the vehicle was manufactured

- Make, model name and serial number

- Chassis number

- Engine number

- Cubic engine capacity

- Number of cylinders

- If the vehicle is petrol or diesel

- If the vehicle is right or left hand drive

- Description of the body

- Price

- Odometer reading

- Extra or special features

- Any defects that may bring the price down

- Customs Form C104A (importing a vehicle in connection with moving your main residence to Scotland)

- Customs Form C104F (importing a vehicle for a six to 12-month period)

- Customs Form C384 (importing a vehicle when duty is applicable)

- Community Transit Document (T2) obtained from customs office in the country of origin

- Registration papers/title

- Police Certificate or Registration

- Insurance policy

- Purchase invoice (original)

- Log book

PETS AND ANIMAL REGULATIONS

Quarantine is required for six months when you import dogs and cats into Scotland in a government facility. Keep in mind that kennel space is limited in these quarantine facilities, and it must be booked in advance, prior to importation.

When importing a petto Scotland, they will need to have the following documentation:

- Health certificate and proof of inoculation

- Customs Form C-5

- Import License (not granted until other requirements have been met, and quarantine in a licensed facility has been arranged)

DUTY AND TAX RATE PERCENTAGE

Used household goods and personal effects including tools of trade may be imported duty free if:

- You are moving your principle home or returning to Scotland and:

- You have owned and used the items for at least six months prior to importation

- You can prove that duty and tax have been paid on these items prior to your arrival in the United Kingdom

- You declare them on the C-3 form

- If you are entering from outside the EC, you must have lived at least 12 months abroad prior to importation, and cannot sell, lend, hire out or otherwise dispose of the items unless you obtain customs authority first

- You are living in another EC country and:

- You either own a secondary home in the United Kingdom or rent one for at least 12 months

- You have owned/used the items at least three months prior to importation and do not plan to sell them within 12 months of importation

- You must prove that duty and tax have been paid on these items prior to your arrival in Scotland

- You declare them on the C-33 form

- If you are living outside of the EC and:

- Your goods are not eligible for VAT free shipping

- You must have lived outside of the EC for at least 12 months

- You either own a secondary home or have rented one for at least two years (24 months)

- You have owned and used the items for at least six months before they are imported

- You cannot sell, lend hire out or otherwise dispose of the items in the United Kingdom within 12 months of importation, unless you obtain customs authority first

- You can prove duty and tax have been paid on the items prior to arrival in Scotland

- You declare them on the C-33

- Special regulations apply to students, newlyweds, visitors, inheritances, those who plan to marry soon, goods originating from EC countries, personal antiques (not for resale), etc

NOTE – Customs regulations are subject to change at any time. The proceeding information is a brief summary of customs regulations applicable to household goods shipments to this destination and is being provided for general guidance to assist our Agents and customers. Since such regulations are subject to change without notice, International Sea & Air Shipping cannot be held liable for any costs, damage, delays, or other detrimental events resulting from non-compliance. Always double check with your local embassy or consulate.

Call our International Moving Specialists @ 1 (866) 315-4170

Moving to Scotland from the USA – all you need to know

Moving to Scotland from the USA can be quite an exhilarating experience given the country’s reputation for stunning landscapes and friendly neighbors! However, before making the move, it’s important to consider some important factors such as visas, housing, healthcare, and employment options.

Scotland is a country with a rich historical and cultural heritage, stunning landscapes, and a vibrant lifestyle. It has everything for both short- and long-term visitors. Researching the cost of living, transportation, and education options is essential when you want to move to Scotland from the USA and stay in the country for a longer period of time than 6 months.

Connecting with local expat communities and seeking professional advice can also be beneficial while settling down in the country post the move. It’s important to plan ahead, be flexible, and embrace the new experiences that Scotland has to offer.

Visa Process for Moving to Scotland from the USA

If you have a valid American passport you can stay in Scotland for 6 months without any visa. However, if you want to move to Scotland from the USA for a longer term than 6 months or want to settle down in this country, then you need to hold a proper visa. There are different types of visas available to relocate to Scotland. Based on your requirements you can apply for the specific one that suits your purpose.

Here is a list of the visas that you can look at –

Work Visa

The first priority should be given to finding a job even before you apply for a work visa to move to Scotland from the USA. You will have to secure a job in this Land of the Brave before the Scottish Government considers you eligible for a work visa. Your employer in Scotland has to sponsor this visa and will assist you in the process to obtain this important document for you to be able to move to Scotland.

Also ensure about this process where your Scottish employer may need to complete a Resident Labor Market Test (RLMT). This is to prove that the company is employing you because you are more qualified for that particular position than any existing and settled resident in Scotland.

Study Visa

The study visa application is relatively easier if you want to relocate to Scotland from the USA on a study visa. First you will have to apply for a course in a school or university in Scotland, be accepted there then apply for the study visa.

Scotland has an admirable and robust educational system. Pursuing a course there is a great idea and it lets you move to some of the prominent cities in Scotland like Aberdeen, Edinburgh, Glasgow, or others.

Family Visa

You can move to Scotland from the USA if your family members have been living in this country and can sponsor your family visa. On the other hand, if you are relocating to Scotland from the USA and want to bring your family members with you, then also you will need to apply for a family visa. While there is a list of eligibility criteria that you need to fulfill, the basics is to offer proofs that you will be able to financially support your family members. Also, you have to confirm that you all are living together.

Best Cities to Live in Scotland

Some of the best cities to live in Scotland include the following:

- Edinburgh – Edinburgh is known for its historic charm and cultural festivals

- Glasgow – Glasgow is renowned for its vibrant arts scene and nightlife

- Aberdeen – Aberdeen offers a high quality of life with its strong economy and beautiful coastal setting

- Stirling – Stirling is an ideal choice for those seeking a smaller city with a rich history and easy access to the Scottish countryside.

Ultimately, the best city to live in Scotland depends on personal preferences and priorities, such as job opportunities, cultural offerings, and natural surroundings.

Scotland is a charming country, full of welcoming and hospitable people and opportunities for everyone. A move in this Gaelic country can be truly rewarding. You can also read our other moving guides on The UK, Ireland, Spain, Switzerland and more.